The Perfect Financial Storm -2.0–2023

This article was published in 2015, fast forward to 2023 below.

The real estate market in 2007 and 2008 was devastated in the likes that we haven’t seen in many, many years. Market conditions have placed a huge burden upon lenders as they find themselves saddled with a massive inventory of non-performing loans(notes). Under normal circumstances, the lender will try to work the problem out directly with the borrower. If that proves unsuccessful, the lender then begins the foreclosure process in order to recover the collateral.

With today’s economic conditions, history is getting ready to repeat itself. Lenders are more cautious than ever. Commercial lending is difficult at best. The dynamics will be different. But…………at this time it is too early to tell what may be happening and how the issues will be addressed.

Great Recession 2.0?

Americans pull hundreds of billions out of banks at fastest pace in four decades

Americans are pulling hundreds of billions of dollars out of banks at the fastest pace in nearly 39 years as many economic experts are beginning to predict a repeat of the 2008 “Great Recession.”

According to an analysis of the most recent data from the Federal Deposit Insurance Corporation (FDIC), “depositors took a total of $472 billion out of their accounts in the first quarter of this year – shattering a 39 year record,” the Daily Hodl reported.

“The quarterly decline is the largest reduction reported in the QBP since data collection began in 1984. This was the fourth consecutive quarter that the industry reported lower levels of total deposits,” the FDIC report said.

According to the FDIC, the “primary driver” behind the withdrawal of deposits was the movement of uninsured deposits as individuals sought to safeguard funds exceeding the FDIC-insured limit of $250,000. Interestingly, during the same period, the amount of insured deposits held by banks actually saw an increase, as people opted to diversify their risk, the outlet reported, adding:

The mass exodus follows the failures of Signature Bank, Silicon Valley Bank and First Republic, which were triggered in large part by the Federal Reserve’s aggressive interest rate hikes.

As depositors leave the banking system, money market funds have witnessed massive weekly cash inflows.

As the first quarter came to a close, assets held by money market mutual funds surged to $5.6 trillion according to Crane data, representing a record high.

During the Great Recession of 2008-09, Americans lost homes and trillions in market value and savings. It was a severe economic downturn that started with the bursting of the US housing bubble and quickly spread to other countries.

The financial crisis was caused by a severe contraction of liquidity in global financial markets that left banks in trouble, leading to an interbank credit freeze. This impaired the ability of any bank to extend credit to businesses and consumers, forcing businesses to reduce their expenses and investments, leading to widespread job losses. As millions of people lost their homes, jobs, and savings, the poverty rate in the United States increased, and much wealth was lost.

The crisis developed gradually, with home prices starting to fall in 2006 and subprime lenders filing for bankruptcy in 2007. By August 2007, it became clear that the financial system was in trouble, as the interbank market froze and banks like Bear Stearns and Merrill Lynch faced major losses. The crisis ultimately led to the collapse of Lehman Brothers in September 2008 and the Great Recession.

The Great Recession was deep and protracted enough to become known as “the Great Recession” and was followed by what was, by some measures, the slowest economic recovery in U.S. history. The recession lasted from December 2007 to June 2009, and the economy did not return to pre-recession levels until late 2011.

When the bubble burst, the banks were left with trillions of dollars of worthless investments in subprime mortgages. Many banks, including Lehman Brothers, had been highly leveraged, meaning they had borrowed heavily to invest in these mortgages, and when the value of the mortgages plummeted, the banks were unable to meet their obligations.

The crisis had far-reaching effects on the global economy. In addition to widespread job losses and increased poverty rates, many countries experienced declines in their gross domestic product (GDP), and the eurozone debt crisis emerged as a result of the recession. The recession also had political consequences, with many people blaming policymakers for not preventing the crisis or responding adequately to it.

The crisis also led to a reevaluation of financial regulations and the role of banks in the economy. Many policymakers and experts believed that the crisis was caused by a lack of oversight and regulation of the financial sector, and reforms were implemented to prevent a similar crisis from happening again.

But, as we’ve seen recently, banks are beginning to fail again anyway despite a raft of new regulations passed in the wake of the 2008 crisis, and home values are reportedly overvalued — again.

Editors Note:

Banks will cause the economic implosion which will show up in commercial mortgages and impact:

- Office

- Retail

- Residential

Look for the butterflies………………..

More to evolve

Reprinted from

https://www.newstarget.com/2023-06-13-great-recession-americans-pull-billions-out-of-banks.html

When buying a non-performing note, the buyer must determine:

- The buyer should conduct due diligence on the loan documents

- Identify all the Stakeholders

- The borrower’s financial condition.

- Are they open to a loan modification?

- Are they motivated and have the means to fight a foreclosure?

- Or will they file a bankruptcy to delay the process.

In addition to the above and like any other real estate investment, one must determine the appropriate exit strategy. In other words, just like the lender, the borrower now holds a note that is not performing and which will require resolution. Those options include following:

- Acquisition Phase–Buy or broker the deal

- Modification Phase

- Property Based Solution

- Paper Based Solutions

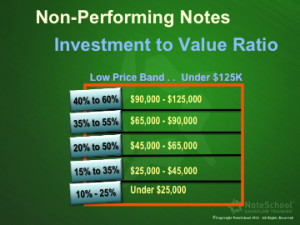

For many buyers, non-performing notes are attractive investments because they typically trade at a large discount off of the secured property’s perceived value. In fact, it is not uncommon to see non-performing notes trade at a discount of up to 80% or more off of the unpaid balance. It should be remembered, however, that this discount is a reflection of the note’s distressed condition and/or the condition of the asset.

Non-performing notes do have great investment potential. However, a buyer should not assume that a non-performing note is a guaranteed shortcut to acquiring the underlying asset. The prudent buyer will conduct thorough due diligence, not just on the underlying property, but upon the borrower, the lender and the status of the loan documents. The buyer must understand why the property is distressed and what additional expenditures in time and capital will be necessary to either bring the loan back to a performing condition, or to recover the underlying asset. When a buyer understands these issues, he will be more able to assess whether the discount being offered is sufficient enough to justify the risk.

Non-performing notes do have great investment potential. However, a buyer should not assume that a non-performing note is a guaranteed shortcut to acquiring the underlying asset. The prudent buyer will conduct thorough due diligence, not just on the underlying property, but upon the borrower, the lender and the status of the loan documents. The buyer must understand why the property is distressed and what additional expenditures in time and capital will be necessary to either bring the loan back to a performing condition, or to recover the underlying asset. When a buyer understands these issues, he will be more able to assess whether the discount being offered is sufficient enough to justify the risk.

Hardly any other asset can offer such aggressive pricing and strong rewards for investors. As the housing correction continues to take place for the next several years, more and more opportunities will be available for investors who are well positioned and willing to take on risk for big rewards. It is the perfect option to control real estate with an option and not have any of the downsides associated with property ownership for pennies on the dollar. An incredible once-in-a-lifetime market condition.