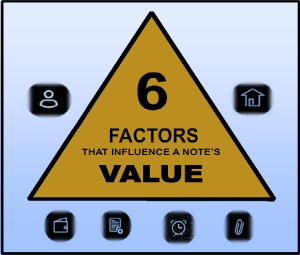

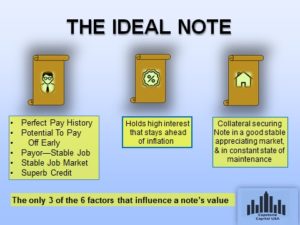

When a note buyer be gins their due diligence, there are 6 factors that are considered when a note is underwritten. They are determining and trying to mitigate their risk. The note seller took the promise of the house buyer that they would pay per the terms of the note. We as the buyer are being asked to assume that promise—that risk. Sometimes cart blanch. Therefore, it is our job to trust but verify. In the event the note is not perfectly structured, we’ll mitigate our risk with a discounted offer.

gins their due diligence, there are 6 factors that are considered when a note is underwritten. They are determining and trying to mitigate their risk. The note seller took the promise of the house buyer that they would pay per the terms of the note. We as the buyer are being asked to assume that promise—that risk. Sometimes cart blanch. Therefore, it is our job to trust but verify. In the event the note is not perfectly structured, we’ll mitigate our risk with a discounted offer.

This is also the first thing an investor checks when going through the due diligence process. The buyer affects many other factor’s in the value on a note such as the collateral’s upkeep, the down payment, the seasoning, etc. Whenever you are valuating a note, making a buyer profile should be top priority. Included in the profile:

- Type of buyer, rehabber or “mom and pop” (sold personal residence)?

- Did you happen to review the buyer’s tax returns?

- Did you verify their credit?

- Income (ratio or proof)

- Job / Employment

- Another words, since you were lending them $$$$, you would want to make sure they’d pay you back?

The credit on a buyer is not just their FICO score, but the 5 C’s of credit and how each factor complements or redeems another.

- Capacity to repay is the most critical of the five factors, it is the primary source of repayment – cash. The prospective lender will want to know exactly how you intend to repay the loan. The lender will consider the cash flow from the business, the timing of the repayment, and the probability of successful repayment of the loan. Payment history on existing credit relationships – personal or commercial- is considered an indicator of future payment performance. Potential lenders also will want to know about other possible sources of repayment.

- Capital is the money you personally have invested in the business and is an indication of how much you have at risk should the business fail. Interested lenders and investors will expect you to have contributed from your own assets and to have undertaken personal financial risk to establish the business before asking them to commit any funding.

- Collateral, or guarantees, are additional forms of security you can provide the lender. Giving a lender collateral means that you pledge an asset you own, such as your home, to the lender with the agreement that it will be the repayment source in case you can’t repay the loan. A guarantee, on the other hand, is just that – someone else signs a guarantee document promising to repay the loan if you can’t. Some lenders may require such a guarantee in addition to collateral as security for a loan.

- Conditions — the intended purpose of the loan. Will the money be used for working capital, additional equipment or inventory? The lender will also consider local economic conditions and the overall climate, both within your industry and in other industries that could affect your business.

- Character is the general impression you make on the prospective lender or investor. The lender will form a subjective opinion as to whether or not you are sufficiently trustworthy to repay the loan or generate a return on funds invested in your company. Your educational background and experience in business and in your industry will be considered. The quality of your references and the background and experience levels of your employees will also be reviewed

Kinda like car dealer, they typically wants to get some down payment. You want to have a safety net.

Things to consider on collateral:

◆ Owner occupied or rental?

◆ Commercial or single family residence?

◆ Rehabbed home or prior residence of seller?

A home (single family residence) sold by the previous owners would be more appealing to an investors than a rehabbed home or one secured by mobile home and land. Previously, most collateral using seller financing were “unique” properties such as mobile home & land, land only or homes that bank’s wouldn’t finance. Due to the current economy however, seller financing is being placed on properties from single family residences to commercial property, giving their notes better value on the secondary market.

- Equity –in the home as it related to the down payment and loan amount. Typically our

underwriters are looking for 25-30% Equity in a single family. 50% on a mobile home or land. Otherwise known as “skin in the game”, the down payment on a note is important for two reasons.

underwriters are looking for 25-30% Equity in a single family. 50% on a mobile home or land. Otherwise known as “skin in the game”, the down payment on a note is important for two reasons.

- The amount of down payment determines the Loan To Value(LTV) on a note (the lower the better), which investors look at when considering purchasing, and

- It shows the buyer’s commitment to the property. The more they’ve personally invested, the greater chance they will continue to not only maintain the property, but stay current on payments.

- Terms of note–The interest rate, amortization and balloon (if applicable) weigh on a note’s value in the following ways:

- Interest: If a note has no interest it is a nail in the coffin of any possible note deal. If the interest rate is low, it will also take a hit on the discount. The higher the interest rate, the less of a discount the seller will have.

- Amortization: The longer the note is amortized, the larger the discount. To combat this, most brokers present clients with a partial purchase offer alongside the full purchase offer.

- Balloon: A note with a balloon has less of a discount because the money is closer to the payout. However, in certain cases a balloon that is too short can play a negative role in evaluating a note. The likelihood of refinancing to pay off a balloon must be logical and practical when cast against the buyer’s credit and current economy.

- Seasoning—pay history. Paying not just their monthly payments, but are the taxes and insurance

paid on time.

paid on time.

Depending on the credit of the buyer and the collateral (rehabber or not) the seasoning for note’s is typically as follows:

- 3-12 months: Best credit, not a rehabbed property

- 12 months or more: Sub 625 credit, rehabbed property

- Paperwork –is there a lenders title policy? How is the note Serviced? Who

pays the taxes & insurance

pays the taxes & insurance

A well written note is typically serviced by an outside servicier, which is paid for by the buyer. We always use an outside servicier, therefore that is another cost we’ll incur.

Finally you have the last factor in a note’s evaluation, the paperwork. What investors verify are the following:

- Note, Deed of Trust, Land contract, etc.

- Federal Disclosures—is the note Dodd-Frank compliant?

- Loan Application Verifications: includes income, employment and dow

n payment.

n payment.

If any of the variables are off on the above, the note will trade at a greater discount. But we can do some really creative stuff.

Call us to discuss your options.