|

Note Investors Forum Meetup – Phoenix

The Next Note Investors Forum Meeting will be

Wednesday, November 6th 11:30am-1:30pm

La Famiglia Restaurant, SE corner of Dobson & Guadalupe, Mesa

TOPICS: Trends In The Note Industry

Highlights from the NoteExpo

Scatter Shooting

Case Studies

Price $16.84 with online registration

$20.00 @ the door

Includes lunch, beverage, information and networking

EVENTBRITE TICKETS @

What The Heck Is My Note Worth Anyway?

Factors Affecting the Value of Mortgage Notes

When you start the process of selling your mortgage note it’s important to keep in mind that how much a mortgage note sells for mostly comes down to risk. Typically, the less risk involved in the note, the greater its market value.

Value of Property

One of the first things a note-purchasing company looks at is the value of the property that serves as collateral on the note. The current market value of the residential or commercial real estate listed on the note can increase or decrease the note’s market value.

Keep in mind, the amount listed on the mortgage typically is not the same thing as the current value on the property, or the amount for which the property was last purchased. Real estate values can fluctuate over time. If you’re not sure of the current value of your property, online resources such as Zillow can provide a rough estimate. During the note-selling process, a more precise quote is given.

A factor which affects property value is the actual type of the property. Typically single family dwellings maintain higher values than other property types like condos or manufactured homes.

Equity from Buyer

The equity the real estate’s owner has in the property factors into the value of the note. This includes the amount of the down payment, as well as payments already received from the property owner.

When a payer has invested a significant portion of his or her own assets into the real estate, the payer has a vested interest in the real estate and is less likely to default on the loan. Thus, a mortgage note with a significant level of equity from the buyer presents a lower risk.

The more equity the homeowner has, the more money a note seller is typically able to get for the note.

Property Owner’s Credit Score

The mortgage note owner’s creditworthiness does not factor into the sale of the note, but the property owner’s creditworthiness does.

The higher the credit score of the property owner, the higher the value of the note. More creditworthiness in the owner means the person purchasing the payments is taking on less risk. Because the buyer of the note is assuming less risk, that money is passed on to the seller.

A low credit score does not automatically mean the note can’t be sold. Other factors such as payment history on the note, and the payer’s equity in the property, can help in cases where a low credit score hurts. Still, a lower score means more risk and thus degrades the note’s value.

Payment History on Note

Payment history on the note also determines how much a mortgage note is worth. This concept is often described as notes either being “performing,” meaning having regular payments, or “non-performing,” which means the payments have not been paid on time.

Being able to show a strong payment history from the property owner can make your mortgage note more valuable.Most private mortgages are not reported to credit bureaus, and so the payments do not influence the payer’s credit score. Thus, positive credit history on the mortgage note can help compensate for a payor having a weaker credit score.

Recourse vs. Nonrecourse

If the payer on the private mortgage is a corporate entity, trust or nonprofit, it helps to have an individual listed as the personal guarantee of the payer. By having a guarantee, it means the note has recourse in the event the entity, trust or nonprofit stops making payments on the loan.

The term “recourse” means the note has someone with whom recourse could be taken in the event the loan is defaulted upon. Though it does not bar it from being saleable, a nonrecourse note has significantly more risk, which degrades its value.

Other Factors

Interest rate and the length of a loan also help determine the value of the note. A higher interest rate and shorter loan term make for a more valuable note.

Other note terms, such as a rider on the mortgage affecting the term, can also affect its value. For instance, some private mortgage notes have a balloon rider. This type of rider lets smaller payments be made for a time, with one lump sum due at the end of the term. This would be instead of evenly distributing the amount due over a series of payments. Any rider affecting the payment schedule can affect the value of the note.

Getting to Know ITV & LTV with Dave Franecki & Kevin Shortle

Recently I was interviewed by Kevin Shortle for his podcast. I think you’ll enjoy it………………

What are LTV and ITV? In this episode, Dave Franecki of Capstone Capital USA, LLC explains what these terms mean and dives deeper on how we can use them in our note investment conquests. Having 30+ years of experience in various aspects of the real estate industry, Dave’s range of experiences includes real estate brokerage, landlord, rehabber, fix and flips, loan officer, credit repair, investor mentor, building and land development, and note investing. With people constantly getting confused with loan to value and investment to value, Dave helps us clear up this confusion by citing some real deal applications and examples……….

There’s something to be said about experience in the business. If you don’t have the experience in the business, there’s no better way to learn quicker than from people who do have that experience. If you’re in the Arizona area, check out Dave and go to his Phoenix Note Investors Forum meetup group. If you’re down there in the Phoenix area, it’s a nice meetup group. You’re growing it like crazy

Getting To Know ITV And LTV With Dave Franecki

I’ve got a repeat guest for this episode. I’ve known Dave for years now. We saw each other again face-to-face. It’s been a while since we’ve seen each other really face-to-face in person. We were at the Noteworthy Convention and was able to spend a little bit of time with him. He spoke on stage, I spoke on stage and afterward we realized, “There are some other topics people need to talk about.” Dave Franecki, welcome.

CLICK HERE FOR THE FULL TRANSCRIPT

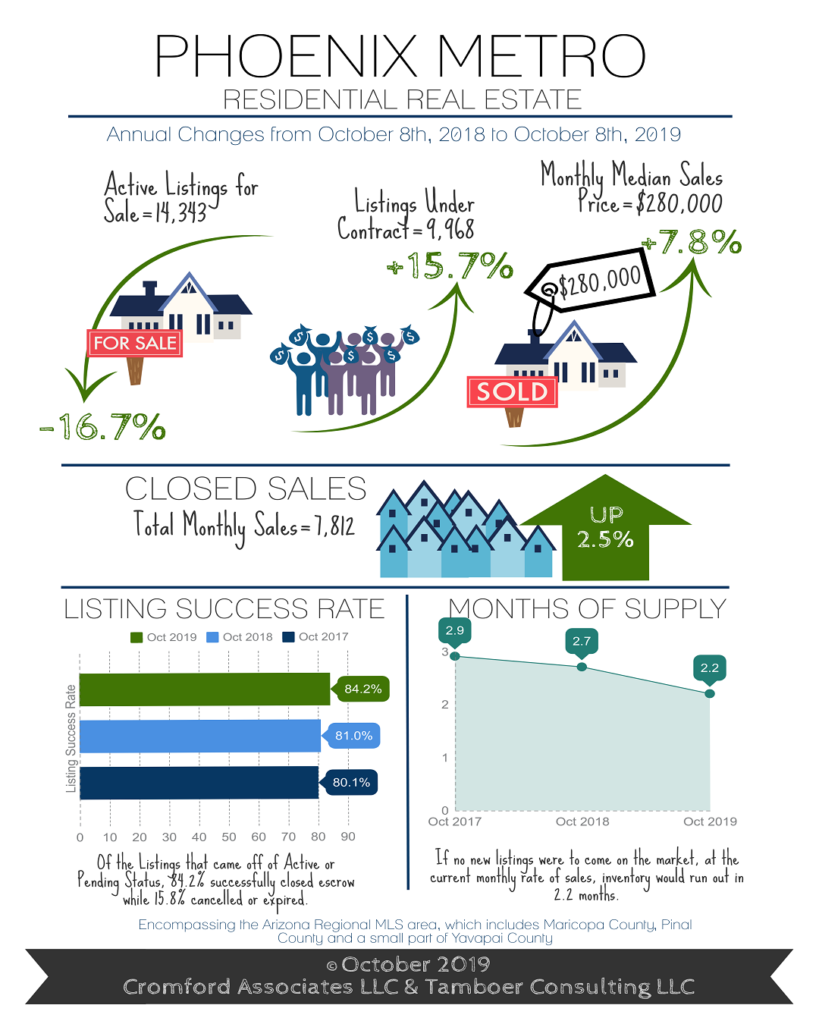

Metro Phoenix Real Estate Overview

I understand many of the folks reading this post are not from Phoenix. You may find this interesting for now, then let’s revisit in a year and compare. Just sayin.

|

|

Why Are Note Seasoning & Verifiable Payments So Important

There are several items a note buyer should verify before purchasing a note. Both are related to the Payor. A note buyer needs to confirm the payor will continue to pay. We are buying a dependable cash flow. To that point, they are foundational. Details the impoortance of both.

OP-ED~~ Loan Modification Re-Defaults

Recently I attended the NoteWorthy Convention in Scottsdale. Kevin Shortle spoke of opportunities in the note arena specifically loan modifications and non-GSE foreclosures and modifications. The following article was an op-ed in MSN Money and is so on target. With the changing economics on the horizon, the re-default rate will increase and may very endanger the US mortgage and housing markets.

the note arena specifically loan modifications and non-GSE foreclosures and modifications. The following article was an op-ed in MSN Money and is so on target. With the changing economics on the horizon, the re-default rate will increase and may very endanger the US mortgage and housing markets.

Wall Street and the news media have paid considerable attention to U.S. home mortgage modifications, but not much notice has been given to the growing problem of re-defaults on these modifications. Re-defaults are a massive problem — and endanger the U.S. mortgage and housing markets. Many of these loans were guaranteed by the FHA

What is a mortgage modification? In the midst of the housing collapse more than a decade ago, mortgage modifications were rolled out to enable millions of delinquent homeowners to avoid having their home foreclosed. In its latest report, the nonprofit Hope Now consortium — the major source for modification data — estimated that 8.7 million permanent mortgage modifications have been implemented in the U.S. since the end of 2007……….The 8.7 million permanent modifications do not include the temporary fixes that lenders have provided. According to Hope Now, roughly 17 million temporary solutions have been rolled out under what’s called “Other Workout Plans.” The two most important ones are called forbearances and repayment plans. Under these plans, millions of delinquent borrowers were provided a temporary deferment or reduction of the payments due until their financial condition improved. These temporary solutions are not reported under permanent modifications. Nevertheless, owners given temporary workout solutions are considered current on the mortgage……………………….

In its most recent report for the first quarter of 2019, the OCC noted that 21% of the most recently modified loans had re-defaulted within six months.

More than 3 million loans guaranteed by the Federal Housing Administration (FHA) that were in Ginnie Mae pools had been modified between 2008 and 2013. A 2014 report found that they had performed badly. Roughly 57% of these modified loans had re-defaulted by 2013

Click Here To Read the Fill Article

Wall Street Banks Tettering on Limited Liquidity

Two days ago a very close friend called me with a market alert. He said for the first time sine 2008, for 4  days in a row, the overnight lending market rate between banks utilized to keep bank liquid jumped to 10%. He asked me, “What is the normal hard money lending rate in real estate?” I answered 10%. To that point, that is a significant occurance. Does that mean banks liquidity is not there? Yes.

days in a row, the overnight lending market rate between banks utilized to keep bank liquid jumped to 10%. He asked me, “What is the normal hard money lending rate in real estate?” I answered 10%. To that point, that is a significant occurance. Does that mean banks liquidity is not there? Yes.

Then today I noticed an article on wallstreetparage.com discussing the very same topic. In escense, the FED is buying up bank debt to keep up the banks liquidity. These are not small time banks–rather the big ones like Bank of America, Goldman Sachs, Citigroup, JPMorgan, Morgan Stanley.

Also, Deutsche bank is leading the pac of il-liquidity.

“The worst of it is that regulators on neither side of the pond have seen fit to rein in the dangerous interconnections that Deutsche Bank has as a major derivatives counterparty with mega banks on Wall Street as well as other European banks. (See After a $354 Billion U.S. Bailout, Germany’s Deutsche Bank Still Has $49 Trillion in Derivatives.)

According to a 2016 report from the International Monetary Fund (IMF), Deutsche Bank is heavily interconnected as a financial counterparty to JPMorgan Chase, Citigroup, Goldman Sachs, Morgan Stanley and Bank of America as well as to big European banks. The IMF wrote that Deutsche Bank posed a greater threat to global financial stability than any other bank as a result of these interconnections. When the IMF made that assessment in 2016, Deutsche Bank had tens of billions of dollars more in market cap than it does today.”

Bottom line for the reason of his call–watch what youpay for assets. Some hedge funds/banks are dumping assets to achieve liquidity.

Capstone has always been a value buyer, NOT a speculative buyer. To that point, we only buy if there is a large safety net. THE WORD OF THE TIME IS–“SAFETY”

The following article is from www.wallstreetparage.com.

What Has Frightened Wall Street Banks from Lending in the Repo Market?

Last Friday the Federal Reserve Bank of New York made it clear that its interventions in the overnight repo lending market were going to be a longer-term action. Call it what you will, the Fed has effectively returned to quantitative easing (QE) where it buys up Treasuries, Federal agency debt and agency mortgage-backed securities (MBS) from financial institutions in exchange for loans.

According to the New York Fed, the program has now been extended to at least October 10 and likely thereafter in one form or another. The Fed will be pumping in $75 billion daily in overnight repo loans while infusing $30 billion in 14-day term loans three times this week for a total of $90 billion in term loans. Click Here For the Full Article

Appraisals will no longer be required on certain home sales less than $400,000

This article was just posted on Housing Wire.com.

Interesting remifications for the Seller Finance business and the Note Buying business.

Draw your own conclusions.

Federal Reserve signs off on appraisal rule change, making change official

For the first time since 1994, certain home sales of $400,000 and under will soon not need an appraisal after federal regulators approved a proposal to increase the threshold at which residential home sales require an appraisal.

Last November, the Federal Deposit Insurance Corp., the Office of the Comptroller of the Currency, and the Board of Governors of the Federal Reserve released a proposal that would increase the appraisal requirement from $250,000 to $400,000, meaning that certain home sales of $400,000 and below would no longer require an appraisal.

The agencies deliberated the rule for nearly a year, taking into consideration the more than 560 comments the agencies received about the rule change.

Last month, the FDIC and OCC signed off on the rule, but were still waiting on the Fed to approve the rule change as well. Read More…

Most Important~~Yield / Investment to Value / Loan to Value

This past weekend I was the keynote speaker for the Saturday NoteWorthy Convention. My goal was to demonstrate to the attendees just how simple notes can be. Just how easy and simple it is to get started in the note business as either a passive investor or an active investor.

To JUMP UP TO THE NEXT LEVEL.

I was able to articulate that the basics can be broken down into how one buys a note with a sense of security in mind.

What that means is focus more on Investment to Value (ITV) and Loan to Value (Loan to Value) vs just the ROI(Return On Investment) aka—yield.

An investor should focus on acceptable ITV or yield, WHICHEVER IS LOWER.

LTV tells a note buyer how much “skin in the game” the mortgagor has, or how much monetary or emotional attachment they have in the property.

ITV, on the other hand, tells the note investor how much he or she will invest in the note in relation to the value of the property. Yield is determined by the best and safest use of the note buyer’s money.

The amount of the mortgagor has invested, along with the value of the collateral and their credit score, will determine the ITV of the note buyer. Yield is the rate of return a note buyer demands when considering mortgagors’ credit, property value, and mortgagor’s equity and other risks.

When applying LTV, ITV and yield to the purchase of a note, all three are important and should be tied to one another. In other words, the down payment, credit score, value of the property, equity in property should be tied to the ITV and yield a note investor demands.

The more risk an investor incurs because of high LTV, the lower must be the ITV, and the yield must be higher. The note buyer will offer the lesser of the ITV vs. yield.

So, which is most important, LTV, ITV or yield?

The answer is that all are important and interrelate to one another.

Yield is determined by the best and safest

use of the note investor’s money. BUT….

YIELD IS NOT REALIZED UNTIL THE NOTE IS PAID OFF.

- 1

- 2

- 3

- 4

- Next Page »