In todays’ world, many investors are in sort of a “conundrum”. Many are sitting on a pile of cash.

They continually ask themselves, what can I do?

Where can I invest?

What is safe and secure with a respectable/acceptable return?

- In the past they have been burned by the topsey turvey stock market roulet.

- Or they made a lot of money in the stock market and are out now because they don’t trust it.

- Or they are or have been landlords, but are tired of tired of the 4 T’s—toilets, tenants, trash and termites.

- Or they have money sitting in a bank earning .2%.

- Or they have been rehabbers but either can’t find deals or the margins have gotten so thin the risk/ reward is just not there.

- Or, they have been hard money lenders at 10% plus, which is a great rate of return. But…..then there is yield drag. Meaning a high return for 6 months, then the loan is paid off and the funds just sit getting dusty with no return. Annualized, the return falls dramatically.

- Or they do not feel comfortable with the current real estate market—afraid of a market turn similar to 2007.

You may fit one of these scenarios. What are you going to do?

Maybe it’s time for a mindset reset.

We play in an inefficient market.

Cash is no longer king.

Deals are KING!!

Think of a parked car in your yard. Is it getting rusty? Are the tires are going flat? Most likely the hoses and belts are rotting and the interior is mice infested?

Dry cash is the same thing. Inflation is devaluing what you have worked hard to acquire.

- Are your IRA fees eating your lunch?

- Is your cash getting moldy with no return from the bank?

- Inflation is definitely devaluing your cash?

- OR…………do you keep waiting for the perfect deal with that very special return?

- How much is that waiting and watching costing you.

- How much yield drag costing you?

- How much is that rate of return?

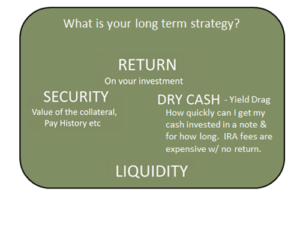

It may be helpful to do a short review of your needs a nd wants.

nd wants.

Consider this illustration.

Think about what is important to you.

Number them in the order of importance

that meets your needs.

There are other options!!

Consider Performing Real Estate Notes.

A properly vetted Performing note provides a quantifiable predictable rate of return on an investment backed by real estate. Passive mail box money.

They can be a perfect match for your ROTH IRA or HSA.

Performing notes can provide a

“SET IT AND FORGET STRATEGY”

Every investor needs passive income in their portfolio.

Check out our NOTE VAULT for some options…

https://capstonecapitalusa.com/notes-for-sale/