Today an IRA administrator questioned -requested an explanation on the sale of a partial. He said he had never seen this type of transaction before. Neither had his compliance officer.

They were confused and requested a simple explanation which follows.

All of the following statements are true:

- Partials can be difficult to understand.

- Partials can be simple.

- Partials may be a safer note investment than selling a full note.

- Partials are a conservative tool which is perfect for a ROTH IRA

- Partials are a great tool to grow ones’ ROTH IRA if one is selling the front payments and keeping the tail, in affect an annuity for the future.

- When one is selling a Partial, you are recouping your initial investment and the tail is effect “free” future cash flow.

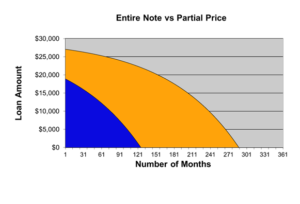

“Bob” is buying 3 partials–funding the last purchase of 125 payments(blue) for $18,900.

My entity is keeping the remaining payments –gold(the tail).My entity is assigning all the payments to him as evidenced by an allonge which keeps this transaction SEC compliant.

This is a great deal for Bob, because I will always be in the deal protecting the remaining payments(gold).

After Bob receives his payments, the remaining payments will be reconveyed to my entity as evidenced by a Reconveyance of Agreement for Deed which references the Purchase and Sale Agreement.

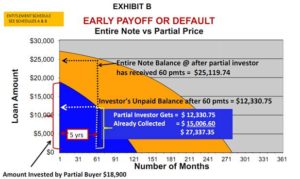

In the event of an early payoff, default or if Bob opts to exercise the 60 month buy back provision the following chart –the Entitlement Schedule –Schedule B illustrates how that scenario will be administered.

The IRA Administrator has executed the following docs:

- Purchase Agreement

- Reconveyance of Agreement for Deed which will be recorded and is subject to the Purchase and Sale Agreement. This doc puts everyone on notice and guarantees the return of the note to me after Tom has been fully paid for his investment subject to the entitlement schedule

Bob will record the Assignment of Contract for Deed to protect himself and will have the original note and the allonge(transfers the note) which will be archived by the Servicier and distribute the 125 payments to Bob. In the event of an early payoff or if the purchaser wants to exercise his 60 month option for an early buyback, his administrator as a road map for future reference.

The IRA company rep understood this transaction when explained in plain English. Additionally he received the following Partial from our NoteHolder’s Handbook–Note Holders Handbook_Partials.

A partial is one of the safest ways to invest in notes.

The IRA Administrator thanked me for providing a “Great explanation!”