It is not unusual for a note holed to sell their note to get a certain amount of cash. But………….when given a quote by a note buyer many time they are shocked at the huge discount and insulted—maybe even angry that a note broker or buyer would try to “steal” their “good” paying note. Any proficient note buyer / broker will offer alternatives in the form of quoting to buy a piece or just some of the outstanding balance. Have you ever bought a full pizza? Have you ever bought just a few pieces of piz za? They can sell a whole pizza or sell it by the slice or several slices. Same principle. As the note owner you are selling some of the payments vs all the payments. By doing so your discount is less and you still have the back end principle / payments or “tail” reverting back to you when the partial note buyer receives all of their purchased payments. The majority of these note sellers are not aware of or familiar with partials.

za? They can sell a whole pizza or sell it by the slice or several slices. Same principle. As the note owner you are selling some of the payments vs all the payments. By doing so your discount is less and you still have the back end principle / payments or “tail” reverting back to you when the partial note buyer receives all of their purchased payments. The majority of these note sellers are not aware of or familiar with partials.

Sometimes as a note owner you only need a specific amount of cash. Selling the whole note makes no cents. There are multiple ways to architect a partial sale. You can sell 12, 24, 60,100 or however many of payments to bring you the cash your need. For the next x# of months, those payments would go to the partial note buyer. After the buyer is paid back, the remaining payments would revert back to you.

Selling a partial gives the note seller a great amount of flexibility. Partials are always a great tool to use when the note holder has an immediate cash requirement and only needs a specific amount of money to cover a specific situation or for a specific purpose. A partial minimizes the discount and frees up cash. It is the best of the best. The terms of the note remain the same for the note payor/borrower. The only thing that changes is the payments are directed to the third party servicing company. Additionally there is contractual language giving the partial buyer the right of first refusal to buy additional payments if they so choose.

What about an early payoff?

Many notes do pay off early. The average time a house or note is paid off historically is 7 – 10 years. If it is paid off early, there are contractual agreements / documents from the outset that are managed by the third party note servicing company determining the payoff and or re-conveyance.

What if the note goes into default?

Unfortunately some notes/mortgages do go into default. IT is a realty of the financial world. If in fact that happens, the contractual agreement spells out the options. Either a buy back from the partial buyer or proceed with the foreclosure /eviction process with the goal of taking back the property and resell it for fair market value. Both the original note buyer and the partial buyer benefit. The partial buyer is made whole with the balance going to the original note seller.

Three Real Life Case Studies

Houston, TX 11/30/15 – Single Family house

Gerry owned a note on a single family house in a so-so area of Houston. He needed money for some personal issues and needed help. I offered to buy the full at a larger discount due to the issues noted below. He was not real enthused with the offer, so we agreed to a partial purchase.

Deal Points

Good Points

Gerry negotiated a great terms with a sort-of strong buyer. Meaning the buyer put down a very strong $14,000 on a $60,000 purchase resulting in a great Loan to Value(LTV). The 7% interest rate was OK. It had a relatively short amortization period of 60 months with a great on time pay history. The 3 Buyer’s FICO scores were weak, but they had a good job history.

Marginal Points

Due to the drop in oil, Houston lost 44,000 jobs. The neighborhood had some marginal houses, but in the process of changing for the good. For these two items, if felt uncomfortable with a full purchase.

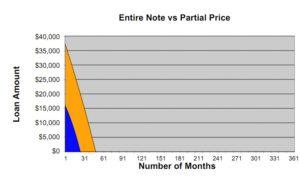

We bought a 24 month partial with the option to purchase the balance in 15 months. It was a secure, safe purchase and Gerry received what he needed. Out Investment to Value was a very secure 26% with a safe Loan to Value of 57%. The graph depicts what we purchased(blue) and what the seller kept. Within one year we bought the gold portion all in our IRA.

Fast forward 11/30/16

Gerry called requesting if Capstone would be interested in purchasing the balance of his note. He had a lingering debt situation. After a short due diligence period, we closed within 10 days. Again Gerry was happy and we were happy owning the full note. Three weeks later we sold the full note to one of our Note Investor Forum Meetup attendees for his ROTH IRA.

Summary

The note seller had a situation, we provided him a solution—twice. The Meetup attendee was in his early 70’s. He wanted a higher yielding note with a shorter amortization period. This was his first note purchase. He is excited to buy additional opportunities.

_____________________________________________________________

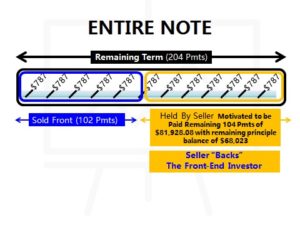

Salem, OR 12/20/16 – Land Parcel

A note colleague referred his friend Kirt his client, Joyce who owned a 13.17  acre out parcel. This was the remainder of a larger parcel where she sold other acreage for a large apartment complex. Joyce wanted funding to purchase some precious metals and have money for a small down payment on a new house. We presented two options—a full purchase and a 102 month partial. She accepted the partial due to the smaller discount and liked the idea of the remaining balance of $68,023 coming back to her in 102 months.

acre out parcel. This was the remainder of a larger parcel where she sold other acreage for a large apartment complex. Joyce wanted funding to purchase some precious metals and have money for a small down payment on a new house. We presented two options—a full purchase and a 102 month partial. She accepted the partial due to the smaller discount and liked the idea of the remaining balance of $68,023 coming back to her in 102 months.

Deal Points

Good Points

Joyce’s buyer had a very good job as a helicopter pilot earning close to $150,000/yr. The servicing company provided a very stable 36 month payment history. She also had a survey of the land which had all utilities. Most likely in the future the apartment complex would expand—buying out the pilot and our partial.

Marginal Points

Joyce did not negotiate good note terms. Only a 4% interest rate (her realtor said that was fair). In reality for land it should have been at least 10%.

We bought a 102 month partial with the option to purchase the balance in the future. It was a secure, safe purchase and Joyce received the funds she needed. We had a very strong ITV of 11% . It was a true win-win. Our referral partner received a referral fee and sold some gold to Joyce. Joyce was able to buy her house and the Capstone investor had a very safe and secure partial note investment in her mothers’ IRA.

Fast forward 4/5/17

Joyce called stating that she wanted to sell the remaining 102 payments ($68,023) which we did for $19,377. She did not want to wait 102 months to cash out the remaining payments. Joyce got what she needed and we received a fair deal. On the entire transaction, our Investment To Value (ITV) was a very safe 17%, in a fast appreciating real estate market. The odds are high the parcel will be sold for development in the near future providing the investor a very nice return because she bought the note at a steep, but fair discount due to the 4% note rate.

Summary

What really happened though is even more normal. Joyce calls back wanting sell the rest of the back-side far before the re-assignment period. Many not sellers buy into a partial transaction because the transaction mitigates the discount. But…………..more often than not, they will want to sell the remaining balance early to meet life needs.

Partials are a unique method of meeting many needs for note buyers and sellers. They should not be over looked. It is an incredible passive investment vehicle for your ROTH IRA

This Case study was/will be presented at the Note Investors Summit April 5-7, 2018 in Irvine, CA