The following article was from CNBC.

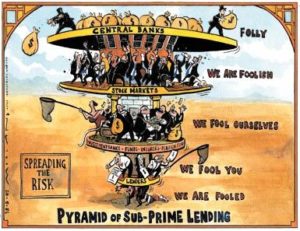

Having lived and felt the pain of the subprime crisis, the return to subprime is a recipe for disaster. No different than the movie The Big Short or the book Fools Gold!!

- The subprime mortgage industry vanished after the Great Recession but is now being reinvented as the nonprime market.

- Carrington Mortgage is now offering mortgages to borrowers with “less-than-perfect credit.”

- Demand from both borrowers and investors is exceeding expectations.

They were blamed for the biggest financial disaster in a century. Subprime mortgages – home loans to borrowers with sketchy credit who put little to no skin in the game. Following the epic housing crash, they disappeared, due to strong, new regulation, and zero demand from investors who were badly burned. Barely a decade later, they’re coming back with a new name — nonprime — and, so far, some new standards.

California-based Carrington Mortgage Services, a midsized lender, just announced an expansion into the space, offering loans to borrowers, “with less-than-perfect credit.” Carrington will originate and service the loans, but it will also securitize them for sale to investors.

“We believe there is actually a market today in the secondary market for people who want to buy nonprime loans that have been properly underwritten,” said Rick Sharga, executive vice president of Carrington Mortgage Holdings. “We’re not going back to the bad old days of ninja lending, when people with no jobs, no income, and no assets were getting loans.”

All loans will not be the same

Sharga said Carrington will manually underwrite each loan, assessing the individual risks. But it will allow its borrowers to have FICO credit scores as low as 500. The current average for agency-backed mortgages is in the mid-700s. Borrowers can take out loans of up to $1.5 million on single-family homes, townhomes and condominiums. They can also do cash-out refinances, where borrowers tap extra equity in their homes, up to $500,000. Recent credit events, like a foreclosure, bankruptcy or a history of late payments are acceptable.

All loans, however, will not be the same for all borrowers. If a borrower is higher risk, a higher down payment will be required, and the interest rate will likely be higher.

“What we’re talking about is underwriting that goes back to common sense sort of practices. If you have risk, you offset risk somewhere else,” added Sharga, while touting, “We probably are going to have the widest range of products for people with challenging credit in the marketplace.”

Carrington is not alone in the space. Angel Oak began offering and securitizing nonprime mortgages two years ago and has done six nonprime securitizations so far. It recently finalized its biggest securitization yet — $329 million, comprising 905 mortgages with an average amount of about $363,000. Just more than 80 percent of the loans are nonprime.

A ‘who’s who of Wall Street’

Investors in Angel Oak’s nonprime securitizations are, “a who’s who of Wall Street,” according to company representatives, citing hedge funds and insurance companies. Angel Oak’s securitizations now total $1.3 billion in mortgage debt.

Angel Oak, along with Caliber Home Loans, have been the main players in the space, securitizing relatively few loans. That is clearly about to change in a big way, as demand is rising.